The full name, title, mailing address, email address and phone number of the person to whom responsive documents should be sent. However, businesses with a high cash balance or frequent transactions may be better off choosing a mid-tier or premier business checking option with more complimentary perks. All subpoenas must include: The full name, title, mailing address, email address, and phone number of the person and/or entity issuing the subpoena and. The Chase Business Complete Banking℠ suite can be the best overall small business banking option from Chase Bank. However, the minimum loan amount varies by loan type. Other financing options include SBA, equipment, trade, and commercial real estate financing.

CHASE QUICKPAY ZELLE FREE

Two savings account benefits include 15 free monthly deposits and up to $5,000 in monthly cash deposits. Otherwise, you must maintain a $1,000 balance in the Business Total Savings account to waive the $10 monthly fee. Linking a Chase Business Complete Banking℠ account to a Chase Business Total Savings account waives the $10 monthly fee for the savings option. The card details on this page have not been reviewed or provided by the card issuer. The information for the Chase Business Total Savings℠ account has been collected independently by Johnny Jet. If your business would earn more via a co-brand airline or hotel business travel credit card, know that those options also feature an exciting lineup. The Chase Ink card family earns Ultimate Rewards®. However, establishing a Chase Bank business relationship can improve the approval odds for getting a Chase small business credit card. Getting Chase business credit cards, even for established businesses, isn’t a guarantee. Having a Chase Complete Banking account can help business owners qualify for other Chase Business products.

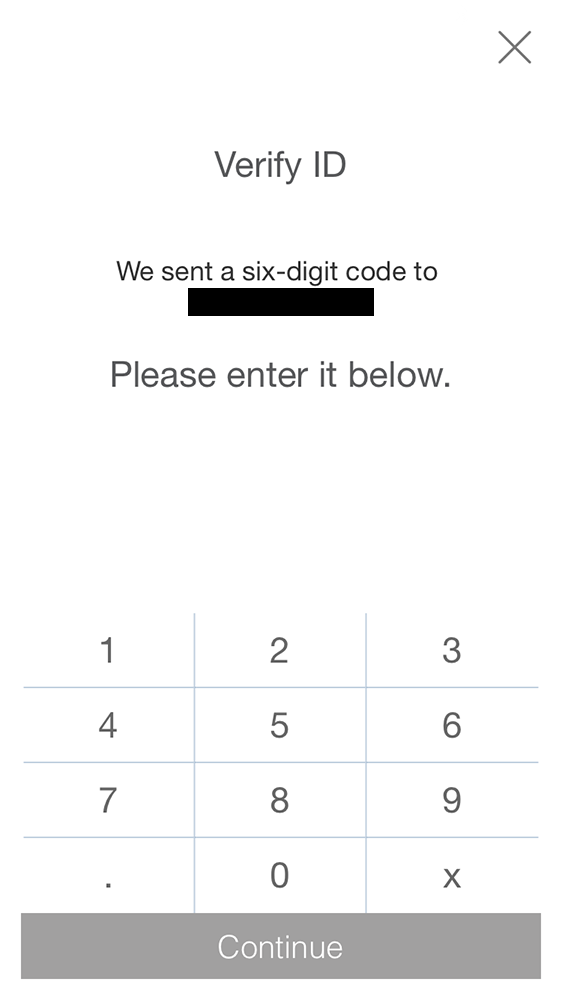

Access to Chase QuickAccept and Chase QuickPay.This Chase Business Complete Banking review wouldn’t be complete without a list of pros and cons. It’s possible to apply online or at a local Chase branch. The following small businesses can apply for a Chase Business Complete Business account: It’s possible to use Chase QuickPay with non-Chase customers too. Chase QuickPay with Zelle®Įnrolling in Chase QuickPay with Zelle® lets you send and receive online payments from clients and suppliers. If your sender is using the Zelle app to send payments, you’ll get the money soon after it’s sent.Customers have access to more than 4,700 local Chase branches and more than 16,000 ATMs across the United States for fee-free withdrawals.If using Zelle® at your bank or credit union, please contact the number on the back of. Our partner financial institutions handle all enrollment and payment related issues with Zelle® in their mobile app and online banking. Then, we apply a hold to confirm that the other bank hasn’t rejected the transfer before the money becomes available in your Chase account. Contact us for assistance with app enrollment, payment related questions or other issues while using the Zelle® app. It usually takes 1 to 2 business days for us to receive the money from the sender’s bank. If your sender’s bank isn’t a Zelle member, you’ll get the money in 4 to 5 business days.

If the bank doesn’t support real-time payments, you’ll get the money in 1 to 3 business days. If your sender’s bank is a Zelle member and supports real-time payments, you’ll usually get the money a few minutes after it’s sent.If your sender is another Chase customer, you’ll usually get the money a few minutes after it’s sent, but no later than the next business day.If your recipient is using the Zelle app to receive payments, they’ll get their money soon after it’s sent.

If your recipient’s bank isn’t a Zelle member, the money should be available 1 to 2 business days after you send it, depending on the other bank’s processing time.If your recipient’s bank doesn’t support real-time payments, the money should be available in 1 to 2 business days.If your recipient’s bank is a Zelle member and supports real-time payments, the money will usually be available a few minutes after you send it.If your recipient is another Chase customer, he or she will usually get the money a few minutes after you send it, but no later than the next business day.

0 kommentar(er)

0 kommentar(er)